Crypto Guide: Top 5 Stablecoins By Market Cap as of June 2024

In a notoriously volatile industry, stablecoins can offer some form of stability. Unlike Bitcoin and other leading altcoins, stablecoins are pegged against the US Dollar or other leading currencies, making them less prone to volatility. They're popularly used as a medium of exchange, a store of value, and trading assets. Although stablecoins make up only a portion of the larger cryptocurrency market, they're popular, have several use cases, and are starting to gain support from institutions and even governments.

The stablecoins' market cap as of June 14th is roughly $161.81 billion. Most exchanges and crypto websites track around 90 stablecoins, many pegged against the US dollar, other leading fiat currencies, and commodities. Stablecoins aims to provide an alternative to the high volatility of most cryptocurrencies, including Bitcoin, Ethereum, and leading altcoins, making crypto investments less attractive for everyday transactions. There are a few types of stablecoins, but the most popular ones are the fiat-collateralized stablecoins. These stablecoins maintain a reserve of fiat currencies, like the US Dollar, as collateral, assuring the coin's value.

Traditionally, these reserves are maintained by third-party custodians, and they're regularly audited. Since these cryptos are more 'stable' in value, they're popularly used for online transactions, particularly in paying for goods and services. As of June 14th, Tether (USDT) remains the top stablecoin and third-largest cryptocurrency by market capitalization, with a value exceeding $112 billion.

Although Tether currently dominates the conversations on stablecoins, there are over 90 stablecoins projects, and five boast a market value of over $1 billion. This article lists and describes the Top 5 stablecoins by market value.

Tether (USDT) - $112.48B

Tether (USDT) is the largest stablecoin in terms of market capitalization. It was launched by Tether Limited Inc. in 2014 and is designed to facilitate the digital use of fiat currencies. Tether aims to disrupt the conventional financial system using a modern approach to money. It allows users to transact using traditional currencies (primarily the USD) without the inherent volatility and complexity common in leading cryptocurrencies. Tether tokens (USDT) are pegged at 1:1 with matching fiat currency and backed by Tether's reserves.

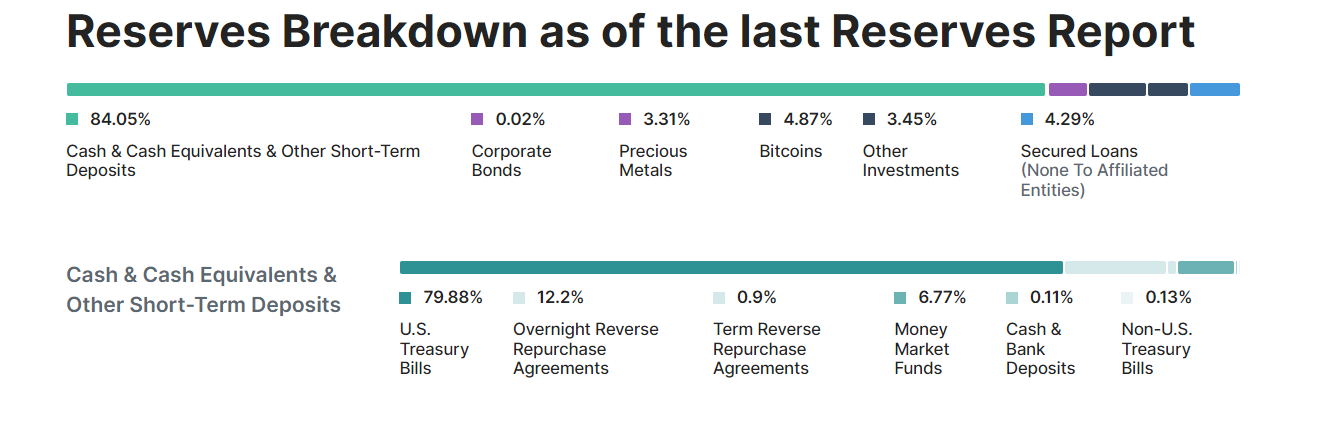

Although its developer is consistently criticized for 'lack of transparency,' it publishes daily records of its current assets and reserves. Tether's reserves breakdown includes cash and cash equivalents, which account for 84% of the total reserves, secured loans, corporate bonds, and even Bitcoin. Under its cash and cash equivalents, Tether's reserves are focused on US Treasury Bills.

Like other cryptocurrencies, you can buy Tether on most crypto exchanges. So, when you buy $100 in Tether, you will approximately receive 100 USDT (since the tokens are pegged against the USD). The company will then boost its reserves by $100 to maintain its 1-to-1 dollar peg. Tether tokens 'are destroyed and removed' from circulation when users redeem their tokens for fiat currencies, like USD.

Unlike many leading cryptocurrencies, Tether lacks a dedicated blockchain, opting to use third-party blockchains instead. The USDT tokens are hosted on Ethereum, Tron, Algorand, Solana, Avalanche, and Polygon.

USDC - $32.50B

USDC is a stablecoin by Circle, a peer-to-peer payments technology company founded by Jeremy Allaire and Sean Neville in 2013. It's the second largest stablecoin and is designed to hold at or near a stable price of $1. Like Tether, the developers behind USDC hold an amount of cash or cash equivalents equal to the amount of USDC in circulation. So, if you buy one USD Coin with $1, your fiat currency is deposited and stored, and you hold 1 USDC token. Now, if you sell your USDC token in exchange for $1, the token is burned or sent to a wallet with no access keys.

Circle prioritizes transparency in its reserves by disclosing its holdings weekly and associated mint and burn flows. According to its website, USDC's cash assets are held in segregated accounts with regulated US financial institutions, and the company's reserve portfolio is held at the Bank of New York Mellon. Circle works with the Big Four accounting firms, and reports are prepared according to the American Institute of Certified Public Accountants (AICPA) standards.

DAI - $5.22B

DAI is a decentralized and collateral-backed cryptocurrency that aims to maintain a price of 1 USD per 1 DAI by locking other cryptocurrency assets in contracts. The company behind DAI is Maker Foundation, founded in 2014 by Rune Christensen, which also created the Maker Protocol.

In 2017, the Maker Foundation created the Maker Protocol, an open-source project that aims to run a credit system allowing users to take out loans collateralized by cryptocurrencies. Today, MakerDAO, a decentralized autonomous organization, oversees the protocol that runs on the Ethereum blockchain.

DAI works differently from other stablecoins for a few reasons. First, DAI maintains its value not by backing US dollars held by a private company (an arrangement for Tether and USDC) but by using collateralized debt denominated in ETH or other cryptocurrencies. Initially, the Maker Protocol supported only ETH as collateral. However, in 2019, the technology was updated to support other cryptos like USDC and BAT in creating a multi-collateral DAI system. This approach diminishes users' risk and boosts the token's stability.

Second, MakerDAOs's model for DAI offers unprecedented decentralization. While other stablecoins (like Tether) boast tokens backed by a reserve of fiat assets managed by third parties, no organization or bank controls the issuance of DAI. Instead, users looking to hold DAI submit Ethereum-based assets (or in other cryptos) into a smart contract and use this as collateral in maintaining the DAI's peg to the US dollar.

Third, token holders can also earn interest on their DAI holdings. Investors who hold MKR or the governance token can set the DAI Savings Rate (DSR), and serve as guarantors for DAI.

Ethena USDe - $3.52B

Ethena USDe is one of the market's newer stablecoins, designed to be decentralized, accessible, and secure. Ethena Labs launched the Ethena USDe token in February 2024 and quickly gained traction in the market. It operates on the Ethereum blockchain, using ERC-20 standard tokens for its operations. Like other stablecoins, the tokens aim to maintain parity with the US Dollar by using a delta-neutral strategy by minting USDe against the collateral while opening equivalent short derivative positions to address the collateral's volatility.

As such, there are certain risks inherent to Ethena USDe, like exposure to derivative market risks. But Ethena Labs 'addresses' these challenges to deliver high yields and promote growth in the DeFi space. The USDe is marketed as "crypto's first fully-backed on-chain, scalable, and censorship-resistant form of money".

Although the market positively welcomed the Ethena token upon its launch, a few critics made their concerns and issues public. Most of the queries and concerns of analysts and experts center on its 'promised annual yield of 27%' by simply holding the tokens. Many say that the purported yield is similar to Terra's UST, at 20%, and we all know that happened next to the project. Ethena addressed these concerns by saying that the potential USDe yields will come from Ethereum taking rewards and the funding rates for its short positions.

First Digital USD (FDUSD) - $2.54B

First Digital USD, or FDUSD, is a stablecoin pegged to the US dollar launched by First Digital Labs in 2023. It currently supports the Ethereum and BNB Chain and adheres to the ERC20 and BEP20 standards. As well all know, these popular decentralized blockchains rely on consensus mechanisms like the proof-of-stake (PoS) or the proof-of-staked authority (PoSA).

According to its website, each FDUSD is fully backed by 1 USD or an asset of equivalent fair value. A custodian in accounts with regulated and reputable depository institutions safely holds these assets. The First Digital USD reserves come in cash and investments in US Treasuries. However, according to a report issued by S&P Global Ratings in December 2023, the company's ability to maintain a peg to the USD has been deemed "constrained".