What is Decentralized Finance (DeFi), and Why Does it Matter?

Decentralized Finance, or DeFi, is a popular buzzword in the crypto industry. If you're into cryptocurrency, a retail trader, or a new participant in the growing industry, then there's a big chance that you have encountered this term. So, what's DeFi, and why are most of the crypto projects today focused on this sector?

Decentralized Finance or DeFi refers to a set of financial services and applications that operate using blockchain technology. These decentralized applications (dApps) offer different peer-to-peer financial services, including trading and lending, and are decentralized, hence the term, and they completely operate without the intervention of a financial intermediary. Experts say that DeFi also democratizes access to financial products since anyone can access the platform, and transactions happen between peers.

Understanding how DeFi works

A public blockchain, cryptocurrency, and smart contracts are three crucial decentralized financial applications (dApps) components. Let's examine each component and how it helps run dApps.

Blockchain

One important component of DeFi is the blockchain, a distributed ledger or database shared among computer nodes. It's the key requirement in cryptocurrency projects and is used to maintain a secure and decentralized record of transactions. A major characteristic of the blockchain is that it's immutable, which means it cannot be changed or altered. Trust is critical in the blockchain's maintenance since a participant cannot change a block. Since it works on trust through consensus, there's no need for a third party to run and maintain the platform.

A blockchain boasts a community of volunteer participants called "nodes" that perform key tasks, like storing and validating new smart contract data and dApp transactions. In DeFi, many developers often build their applications on top of existing blockchains. Two of the most popular blockchains for dApps projects are BNB Chain and Ethereum, with over 5,353 and 4,061 dApps, respectively, as of June 15th. Developers build dApps on existing blockchains to save time and money and allow these dApps to be interoperable with other apps built in the same blockchain.

Cryptocurrencies

Cryptos are important in powering the blockchain networks and incentivizing users to participate in managing them. Users pay fees using the blockchain's native token to participate in or perform dApp-related activities. For example, users must pay ETH fees if the dApp runs on the Ethereum blockchain. Or if it runs with the Cardano blockchain, the dApps participants will pay the fee using the platform's native Ada (ADA) cryptocurrency.

Sometimes, these native tokens have other use cases; for example, they can work as governance tokens. Holders of governance tokens can participate in the decision-making that shapes the protocol's management and strategic decisions. An example of this is Maker, the governance token of the MakerDAO protocol. MKR holders can participate in decision-making, setting rates and collateral requirements.

Smart contracts

dApps are autonomous because they use smart contracts free from human or third-party interventions. Smart contracts are self-executing computer programs that automatically initiate contract obligations between two parties when specific parameters are triggered. These work using the "if-and-then" semantics common in computer programming. Nick Szabo, one of the early crypto supporters, explains the smart contract functionality using the vending machine as a real-life example. Putting $1 into the vending machine automatically dispenses a snack for you, and the process works even without an external influence. Smart contracts work like this, designed to execute functions autonomously.

A popular dApp at work is the DAI DeFi application. DAI lets users lock their cryptos into a smart contract on the Ethereum blockchain. New DAI tokens are generated upon deposit and can be traded or deployed on other DeFi platforms to generate yields. If the user wishes to collect the locked assets, he returns the DAI and pays a fee as interest.

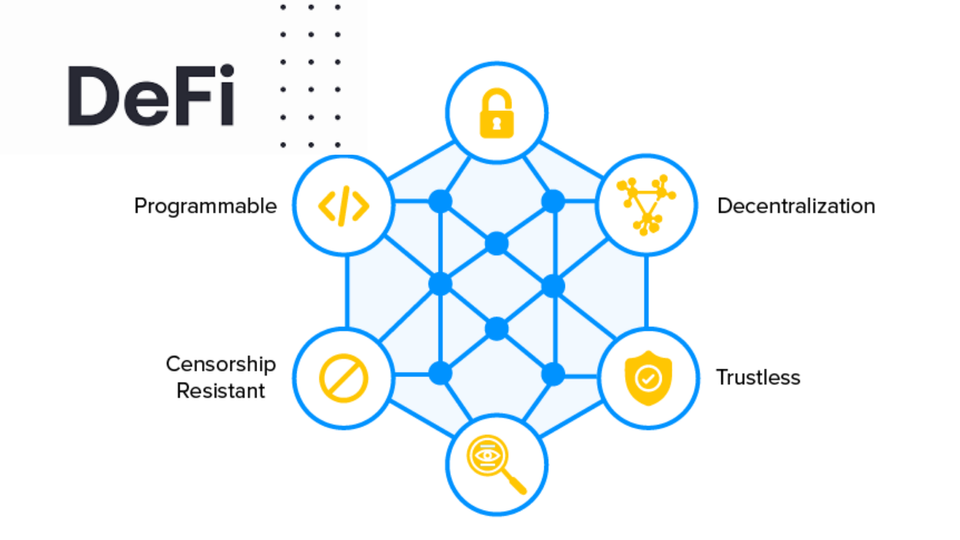

What are the characteristics of DeFi?

Many decentralized finance projects were initially hosted and developed on the Ethereum blockchain. However, DeFi projects have expanded to other blockchains, including BNB and Polygon. DeFi's purpose remains the same regardless of its host blockchain, and all share the same characteristics.

Decentralized and permissionless

A blockchain is permissionless if a participant can join the platform without permission from a centralized authority. Also, it's decentralized if it operates in a peer-to-peer (P2P) manner and is open, transparent, and censorship-resistant. Decentralized finance works this way since individuals can join anytime, and there are no third parties that influence or execute the transactions.

Non-custodial

Many DeFi solutions today are non-custodial, meaning individuals retain control of their assets or other financial instruments. Participants can leverage any financial instrument, like DeFi lending and borrowing, on their own terms without third-party intervention or custody that traditional banks require. In short, it gives users much control over their investment decisions in real-time, using a mobile device, wallet, or DeFi application.

Immutable

Immutability is a data characteristic, meaning it cannot be changed or edited once added to the blockchain. Decentralized finance technologies and the blockchain are immutable, irreversible, and tamper-proof. DeFi systems are transparent, safe, and secure thanks to these characteristics.

Programmable

Smart contracts are programmable, which allows users to complete specific transactions in real time without the help of intermediaries. Some of these tasks include executing agreements and triggering a mechanism.

Open and interoperable

Many public decentralized finance projects boast an open framework allowing individuals to participate. These DeFi projects are also built on existing blockchains, like Ethereum and BNB, which promotes interoperability.

Possible uses of DeFi apps

The most popular use case of DeFi cryptos is lending and borrowing. Today, DeFi cryptocurrencies allow users to get loans using computer software without the help of a traditional intermediary. Instead of a paper contract, these dApps use code to automate the maintenance margins and interest rates retired in lending. Using a code also allows automatic liquidation if the balance falls below a collateral ratio. As mentioned, MakerDAO is one of the pioneers in decentralized lending.

DeFi is also useful in decentralized exchange platforms (DEXs). A DEX is a peer-to-peer marketplace for buyers and sellers. These platforms are non-custodial, meaning users retain control of the private keys. Since no central authority governs the exchange, DEXs rely on smart contracts to execute transactions under specific conditions and record each transaction on the blockchain.

DeFi is also helpful in the market for non-fungible tokens (NFTs). NFTs are immutable and verifiable cryptographic assets representing anything from paintings and trading cards to tickets. Today, blockchain platforms rely on in-game play-to-earn systems that reward users with NFTs.

DeFi challenges everyone should know

Decentralized finance projects democratize access to finance tools and services. While DeFi has benefits, developers and users must consider a few issues and challenges.

First, there's the perceived complexity of DeFi, which is difficult to understand if you're a beginner or don't have a background in programming or cryptocurrency.

Second, you can't find customer support that can provide technical assistance if you need help or have questions.

Third, since DeFi projects also work with cryptos, volatility is always a concern. No central authority can control or limit transactions or address market momentum.

Finally, security is still a concern for DeFi projects.