April 2024 Bitcoin Halving- What Happens Next?

The next Bitcoin halving will happen in the next few days, and it's one of the most eagerly anticipated events by the crypto community this 2024. Many are hyped ahead of the event, speculating on the potential price action as Bitcoin's reward for mining will be cut in half. So, what exactly happens in a halving event, and is the latest buzz justified?

The cryptocurrency industry is ever-evolving, with many new technologies and mechanisms introduced into different projects. As the world's premier cryptocurrency, Bitcoin dominates much of the conversations with its tested blockchain and consensus mechanism and cyclical improvements and maintenance on its blockchain.

One important update on the blockchain is 'halving,' which supporters say is a deflationary mechanism that aims to cut the rewards of mining in half. According to developers, halving allows Bitcoin to address the potential impact of inflation, thus making it more scarce and potentially boosting its value.

Bitcoin halving happens when the rewards for Bitcoin mining are cut in half and happens every four years. As of this writing, the mining reward is 6.25 BTC, and after the halving event this April, it falls to 3.125 BTC per block. Aside from this

Reduced supply and a spike in BTC prices?

Once the halving is completed sometime in April, the mining production will reduce from 900 to 450 Bitcoin daily. The obvious takeaway here is that it drives the coin's scarcity. This halving policy is part of Bitcoin's white paper and written into its mining algorithm to address inflation by maintaining scarcity. Theoretically, a reduction in Bitcoin supply may increase price if demand remains the same. Industry observers and traders look forward to this important event in Bitcoin's story as it generally positively impacts prices.

One expert says the Bitcoin halving is a "significant catalyst for positive price action" in the market. Since there's a reduction in supply, assuming that demand remains constant or even increases, it can lead to a price increase. According to one estimate, the demand impact is equivalent to buying up to $23 million BTC daily for the next four years. And with a surge of interest in spot Bitcoin ETFs and financial institutions' participation, we may be going to witness another breakout year for the cryptocurrency.

Potential for investment

Initially, Bitcoin wasn't for trading and investment. The crypto developers introduced it as a payment option that aims to be fast, private, and free from third-party influence. Soon, Bitcoin became popular with investors and traders when they saw its potential for gains. Retail traders became interested in Bitcoin, and soon, many established financial institutions began buying coins, creating demand.

For long-term investors, the scheduled halving is an opportunity to grow their holdings since it represents a reduction in supply and a potential increase in value. However, the scheduled Bitcoin halving puts most traders and investors on shaky ground as it becomes a subject of speculation.

Speaking of speculation, many traders and observers say that Bitcoin may soon hit $100,000, an all-time high. Historically, Bitcoin reached new all-time highs months after a halving event. We're in different times this year, with plenty of (Bitcoin) growth drivers, like the money flowing out of gold, the SEC's approval of spot Bitcoin ETFs, SEC's approval and the entry of esteemed institutions like Fidelity Blackrock.

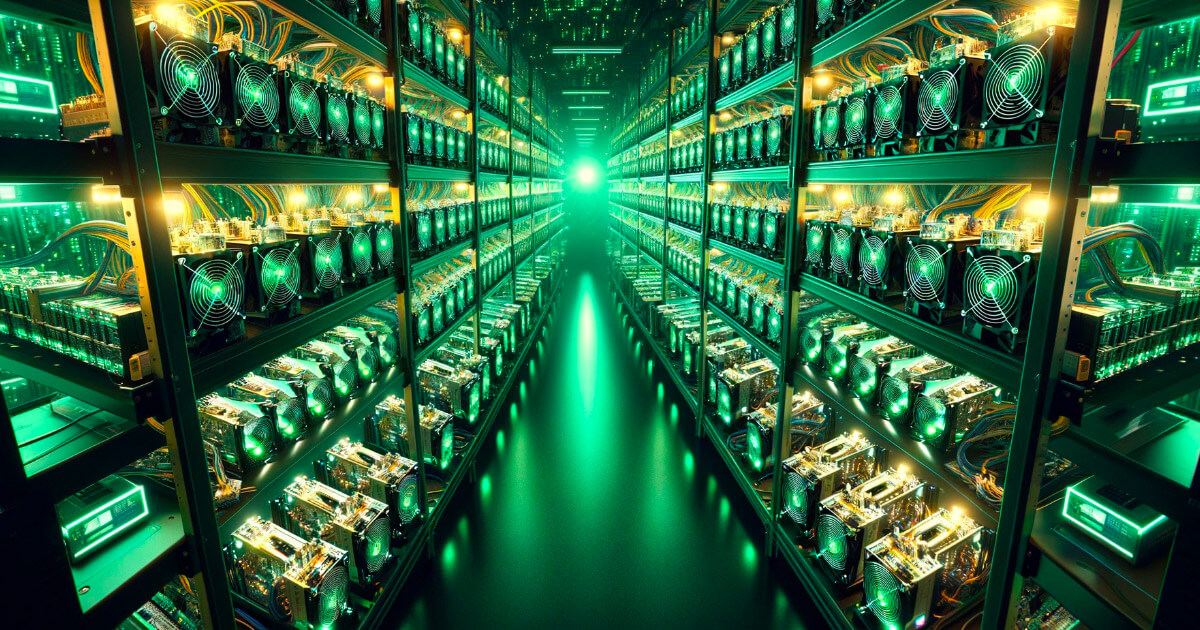

Challenges ahead for the mining community

Mining, a crucial component of the Bitcoin network, faces challenges ahead. The most obvious challenge is the fewer rewards that miners get post-halving. From 6.25 BTC, miners will get 3.125 BTC this year, potentially transforming mining into a less lucrative venture, especially if the coin's future prices will not compensate for the reduced rewards.

Observers say this can lead to a consolidation in the mining industry, where some small players get out of the market, and others that struggle to compete merge with larger and more efficient mining teams. Here are a few more takeaways from the expected Bitcoin halving event and its impact on miners:

- From hereon, mining firms and individuals will focus on efficiency to remain in the black and face the harsher economic landscape after halving. This can be costly since many miners must upgrade to more efficient and low-consumption equipment.

- Individuals and small groups of miners may face increasing pressure as larger companies consolidate and buy up smaller operators. Those who are unprepared or struggling to service their loans may default or face legal action. Lenders are also at risk if Bitcoin miners default on their loans. These companies may inherit the equipment or even companies, which offer a unique set of problems. For example, these companies may face the rapid devaluation of these PCs and equipment as new ones are upgraded and introduced in the market.

Post-Bitcoin halving- Looking ahead

Regardless of your role or biases on Bitcoin, one thing remains clear: the upcoming Bitcoin halving is crucial for its blockchain and the crypto industry in general. It's a critical blockchain upgrade that aims to protect Bitcoin from the effects of inflation and ensure that it remains a scarce resource.

The future of Bitcoin mining will slowly transition to relying primarily on transaction fees once all 21 million coins have been mined. This will be realized approximately 31 years after the blockchain was first introduced. Miners must prepare themselves for this change, and for traders and investors, the speculative nature of Bitcoin pricing will remain.