Crypto Guide: What is Bitcoin Halving?

Now that the sizzling Bitcoin price action has slowed (at least for now), attention has shifted to halving. Observers and retail traders are excited, knowing the dynamics behind Bitcoin halving, particularly its influence on pricing. So, what's Bitcoin halving, and is the excitement over the price justified?

Bitcoin halving happens every four years, where the new Bitcoins created per block are halved. The blockchain network takes about four years to open 210,000 more blocks, a standard set by its creators that continuously reduces the rate at which this digital coin is introduced.

Initially, the reward for the miner was 50 Bitcoins. On its first halving, on November 28th, 2012, the reward was reduced to 25 BTC; then it became 12.5 BTC, to 6.25 BTC, and on the next halving, expected to happen sometime in April 2024, the reward will fall to 3.125 BTC. As of March 2024, roughly 19.65 million coins are in circulation, with around 1.35 million left to mine. This Bitcoin mining principle limits supply and is seen by many to push the Bitcoin price up.

Bitcoin's White Paper and Halving

Interestingly, Bitcoin's white paper did not mention halving directly. However, the paper highlighted the idea of a limited supply of coins and the mechanisms in place to control the creation of a new set of coins. Specifically, the white paper caps the number of Bitcoins to be created at 21 million, and the rate at which new cryptos are mined or created will be halved every four years, which we now call Bitcoin's halving process.

Section 6 of Bitcoin's white paper explains the guiding principle behind the halving process. It compares the addition of new coins to gold mining, where they use resources to add gold into circulation. In Bitcoin's case, the resources come from CPU time and electricity.

What happens in Bitcoin mining?

The process of adding new crypto to circulation is called mining. Specifically, Bitcoin mining refers to the process by which individuals use computers or mining hardware to participate in the blockchain network as validators or transaction processors. Once a block is filled with transactions, it's closed and sent to a mining queue for verification. Then, Bitcoin miners compete to be the first to find a number with a value less than the network's set target. This hash is a hexadecimal number that features all the encrypted information of the previous blocks.

The mining process confirms if these transactions in the blockchain are legitimate and creates a new one. Then, nodes verify these transactions as part of a series, creating a chain of blocks with information and forming a blockchain.

The case for Proof-of-Work (PoW) in Bitcoin mining

The process of guessing the correct or closest number (hash) is called the proof-of-work (PoW), a concept explained fully in Section 4 of Bitcoin's white paper. The section explains the principle behind proof-of-work, which solves the problem of determining representation in decision-making.

It argues against using one-IP-address-one-vote, as it only benefits those who can allocate many IPs. Instead, in the proof-of-work, verification operates using the one-CPU-one-vote mechanism. In short, the majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it.

Bitcoin mining

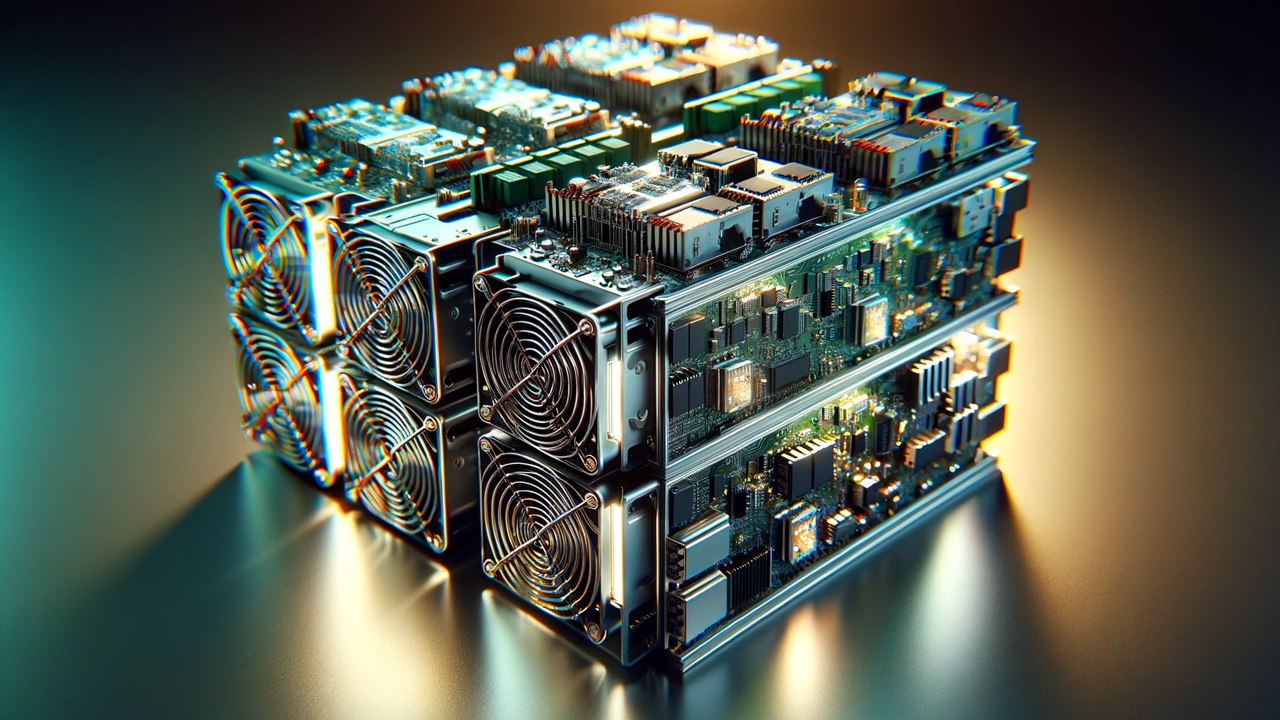

In Bitcoin mining, miners compute the target hash by randomly making guesses, which requires major computing power. The task becomes more difficult as more miners join the network. Mining is a power-intensive and expensive process often reserved for the tech-savvy and those with access to funds. Individuals interested in mining require hardware called application-specific integrated circuits (ASICs) that cost roughly $10,000.

In addition, ASICs consume huge amounts of power, which has drawn criticism from environmental groups and also impacts the profitability of mining. After the next halving, a miner who successfully adds a block to the blockchain gets 6.25 Bitcoins as a reward. As of today's prices (March 26th), 6.25 BTC translates to $439,249.38.

So, what happens after Bitcoin halving?

The excitement is on for the next halving, and many look forward to Bitcoin's 'possible price increase.' In addition to price another erratic price movement, there are a few more benefits and things to expect from this momentous event.

Hedge against inflation

In Economics, inflation refers to a percentage increase in the price of products in the market. Higher inflation decreases the consumer's capacity to buy goods at a given moment. Bitcoin's halving addresses possible inflationary effects on the crypto by lowering the rewards and maintaining its scarcity. However, this protective mechanism does not apply to the inflationary effects of fiat currencies, especially when crypto is converted.

Higher demand

By halving the mining rewards, Bitcoin's market supply decreases. As students of Economics know, with less supply of a commodity, the price increases. Reviewing the historical price of Bitcoin, we can see that its price generally increases after each halving event.

Challenging times ahead for miners

Since the rewards are cut in half, mining becomes less attractive and profitable for miners. Mining is now highly competitive, and miners must always upgrade their computers and consume more energy to compete and become viable.

So, what lies ahead for consumers and retail traders?

Most retail traders and industry watchers are keenly awaiting Bitcoin's halving event. Multiple news stories and blogs underscore the expectations for its highly volatile price action, and many are betting on its increase in market price ahead of the halving.

There are major implications for the blockchain network. For miners, some challenges lie ahead. Halving not only results in fewer rewards but can also create consolidation in the ranks as some small miners and teams drop out of the industry or are taken over by larger players who have the means to spend on better and more powerful machines.