Bitcoin Rallies As Republican's Donald Trump Wins US Elections

Bitcoin, the world's top digital asset, is testing new highs this week, just days after Republican Donald Trump won the election. With Trump's pro-crypto and Bitcoin stance and the support of Twitter/X owner Elon Musk and other crypto personalities, many market analysts and observers are counting on bullish price action for Bitcoin and other digital assets. A day after the elections, Bitcoin hit $75,639.08, the asset's best since March. Nearly a week after the elections, Bitcoin continues to rally, testing new highs. And based on November 11th, Monday's trading, Bitcoin's price topped $87k for the first time.

Bitcoin and the crypto community are still high days after the November 5th US presidential elections. Days before the polls, Bitcoin's price hovered at the $68k to $70k level, with plenty of uncertainties on who would win and increasing debates on crypto policies and regulations.

A day after the polls, with Republican Donald Trump quickly cruising to a win, Bitcoin breaks $75,639.08. Bitcoin's price surge continues over expectations that Trump will create favorable policies and regulations on Bitcoin and other digital currencies. Trump was seen as the pro-Bitcoin candidate in his battle with Kamala Harris.

Although Harris also mentioned some plans for crypto, including her future support for innovative technologies like Bitcoin, Trump's proposals were bolder and resonated more with the voters. The result is a bullish sentiment on Bitcoin, with spillover effects on other leading altcoins that continue well after the elections.

Last Sunday, Bitcoin surged to another record high, passing $80,000 shortly after 1200 GMT. The market's sentiment appears clear: most traders, investors, and analysts are betting that the presumptive US President, Donald Trump, will be good for Bitcoin and the cryptocurrency in general.

As Trump celebrated his possible victory on Election Night at the Mar-a-Lago, he was joined by popular celebrities, like Twitter/X's Elon Musk, Cantor Fitzgerald CEO Howard Lutnick, and Robert F. Kennedy, connected by cryptocurrency.

Trump's initial reluctance turned to optimism and a friendly tone

Trump initially dismissed Bitcoin and digital assets as a "scam" during his first presidency. However, everything changed when Trump decided to run this year. Trump signaled a friendly tone that favored cryptocurrency and indicated a few policy changes and plans he intends to pursue once he becomes the next president.

Legitimize Bitcoin as a digital asset and create a strategic crypto stockpile

In a Nashville Bitcoin conference last July, Trump addressed his plans for Bitcoin should he win the presidency. He said he'll ensure the federal government never sells off its Bitcoin once he wins. At that time, Trump did not explicitly mention a formal reserve of Bitcoin.

In his keynote speech, Trump shared what many holders knew: never sell Bitcoin. He then pledged to maintain the country's current holdings, confiscated from criminals and hackers. Trump stated that it would be the policy of his next administration to keep all Bitcoin the goverment currently holds or will acquire in the future. Under President Biden's administration, the US Marshals Service auctioned these assets, often impacting crypto prices.

A revamp of SEC leadership

Market analysts and observers are also examining the possible reshuffle at the Securities and Exchange Commission (SEC), which Chair Gary Gensler currently leads. Gary Gensler came to the agency ready for the job with experience and technical competence. At MIT, he lectured on Blockchain and Money, and in one video from 2018, Gensler was caught saying that Bitcoin, Litecoin, Bitcoin Cash, and Ether are "no securities."

However, things changed when he assumed office, and in an interview with the New York Magazine, he shared that "everything other than Bitcoin" is a security. Under Gensler's leadership, the SEC has filed investigations against crypto companies, including Binance and Ripple's XRP. Gensler's brush with top crypto bigwigs has led Trump to target Gensler in many of his public statements.

In one public remark, Trump promised to remove Gensler from his post. Interestingly, the US President must be able to remove the SEC chair. Even if Trump had removed Gensler from the agency's chairmanship, he would have remained a commissioner.

Under Gensler's leadership, the SEC has filed over 100 legal actions against cryptocurrency firms. In many interviews, Gensler argued that much of the industry is under the SEC's jurisdiction, and these lawsuits are a way to regulate the sector. However, crypto firms and industry leaders have questioned Gensler's "aggressive approach to management," leading many to question his leadership and campaign for his ouster. Cryptocurrency firms argue that these recent lawsuits don't give regulatory clarity and instead reflect an overreach on the part of the agency.

In addition to the SEC, Trump plans to establish a "Bitcoin and crypto presidential advisory council." He added that the rules for this new council should be written by people who are passionate about technology.

Bitcoin should be mined in America

Last June, Trump met with a dozen Bitcoin mining experts and executives at Mar-a-Lago to discuss the technology and the mining industry. The one-hour-and-a-half meeting was Trump's first meeting with experts securing the $1.5 trillion BTC network by running complex computing machines. Representatives from different BTC mining groups, such as Riot Platform, Maraton Digital Holdings, CleanSpark, Terawulf, and Core Scientific, attended the meeting.

Immediately after the meeting, Trump went on social media to discuss the benefits of Bitcoin mining. In a post at Truth Social, Trump stated that he wants the remaining tokens to be mined in the US and make the country energy-d0minant. The incoming president further adds that if cryptocurrency will define the future, then it should be mined, minted, and made in the US.

Bullish sentiment for Bitcoin continues

As of this writing, Bitcoin continues its bullish run, with The Guardian calling it the "Trump Pump." Last Sunday, Bitcoin's price hit $80k for the first time, which thrilled traders and other market participants. The asset's rise continues this week; based on Monday's trading, Bitcoin has topped $87,000 for the first time, benefitting from Trump's second presidency. The top digital asset reached a high of $87,198 last Monday before dropping. What's interesting about Bitcoin is that it has more than doubled from around $37k 12 months ago.

According to Matt Simpson, a market analyst at City Index, Bitcoin's recent price action is the "Trump Pump," as traders and analysts bet that Trump will implement favorable policies for cryptocurrency.

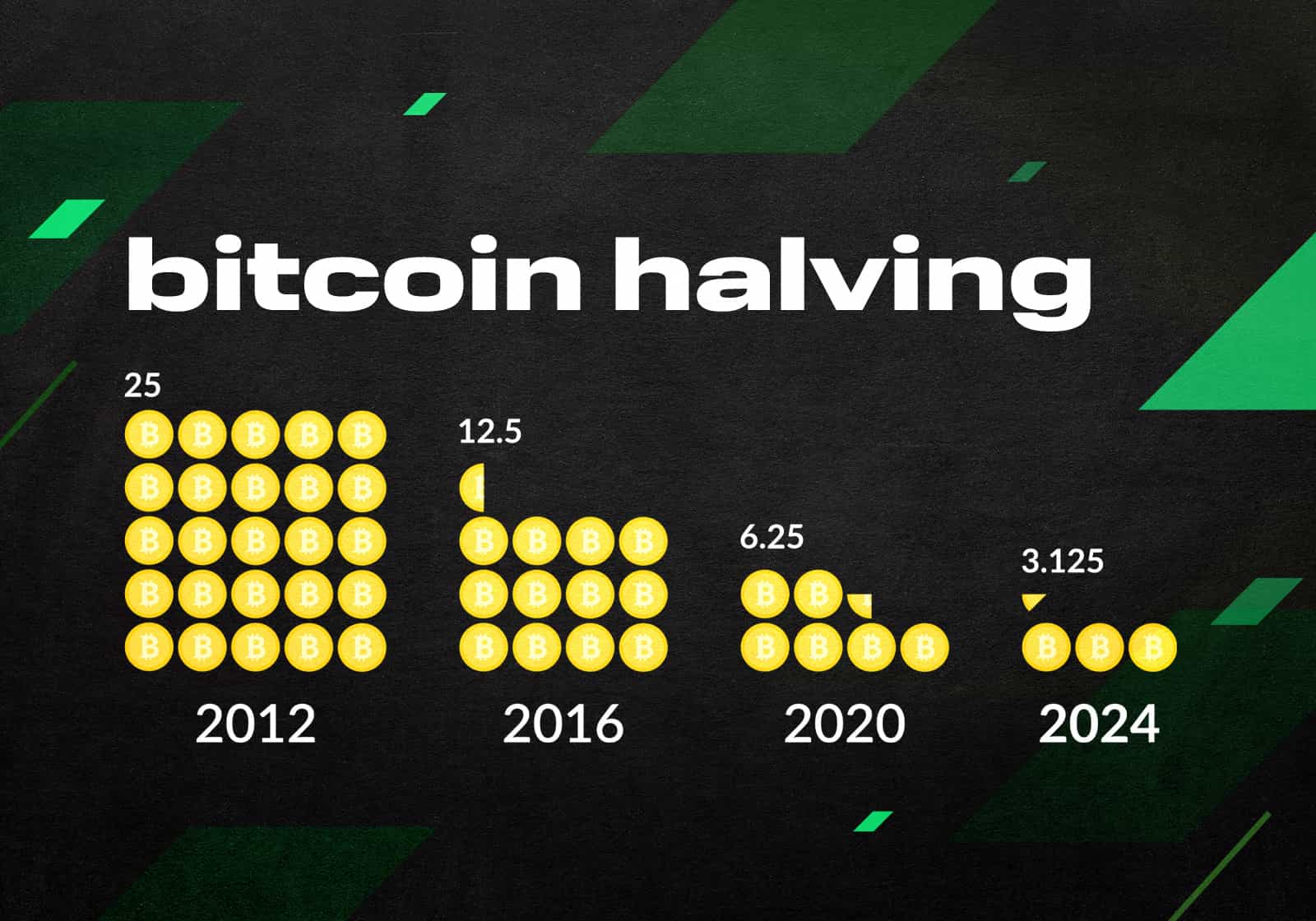

Aside from Trump, other stories are driving Bitcoin's price this month. According to Jessie Myers, Onramp Bitcoin co-founder, one primary reason for Bitcoin's run is the asset's recent halving. Myers says that we're "6+ months post-halving", which creates a scarcity of digital assets in the market. The Bitcoin halving last April reduced the rewards from 6.25 BTC to 3.125 BTC, which means that as each block becomes harder to solve, rewards become lesser, too.

Myers added that post-halving has created a supply shock. There's not enough Bitcoin available at current prices to meet demands, says Myers, and this supply-and-demand equilibrium should be restored.

The approval and introduction of the Bitcoin ETFs on January 1st of this year also contributed to an increase in demand. Immediately after the ETFs were approved, the market saw massive inflows, with Blackrock's iShares ETF as the leader. Last November 11th, US Bitcoin ETF trading saw another massive inflow, at around 13,940 Bitcoins bought daily, compared to just 450 tokens mined. Blackrock's iShares Bitcoin Trust (IBIT) has benefitted much from Bitcoin's ascent and now boasts $34.3 billion in AUM as of Friday.

Analysts are expecting Bitcoin's price to go even higher. Onchain analyst James Check shared Myers's statement and compared Bitcoin's market cap to gold. Another market analyst and financier, Anthony Scaramucci, shared the same thoughts that Bitcoin's price action is still early. Scaramucci is confident that the US will set up a strategic Bitcoin reserve, and other countries will follow, together with institutional asset managers and allocators.

Currently, 94% of all Bitcoins in existence are already in circulation or have been lost, which means that only 1.2 million Bitcoins are left to be mined, making this digital asset a genuinely scarce resource.